May 27, 2025

Inside Berachain: A Next-Gen Layer 1 with DeFi at Its Core

Berachain is a high-performance, EVM-compatible Layer 1 blockchain built with the Cosmos SDK, featuring a unique Proof-of-Liquidity (PoL) consensus that rewards users for providing liquidity rather than just staking tokens. Governance is driven by $BGT, a non-transferable token earned via BEX participation, allowing holders to vote on key protocol decisions and aligning economic activity with network direction.

Network Type

Layer 1 Blockchain

Consensus Mechanism

Proof-of-Liquidity

Genesis Token Allocation

500 million $BERA

Biyond Medium Term Trade Blotter

Entry Price

$3.00

Target Price

$5.00

long

Issued at May 27th, 2025

Protocol & Governance

Berachain has raised over $142 million in funding, primarily across 2023–2024. It is backed by top-tier crypto-native venture firms including Polychain Capital, Hack VC, HashKey Capital, Shima Capital, and DAO5. Its $100 million Series B round in April 2024 pushed the project to a $1 billion valuation. This strategic capital has supported its ecosystem growth, validator incentives, and infrastructure partnerships such as with Google Cloud.

Peak Metrics

-

Mainnet TVL: Peaked at $3.26 billion in February 2025; currently around $1.184 billion as of May

-

Live dApps: 250+ dApps on the Berachain “Bartio” Testnet.

-

Valuation: Achieved $1 billion valuation in its 2024 Series B funding round.

Tokenomics & Use Cases

$BERA serves as the native utility token within the Berachain ecosystem, primarily used for:

-

Gas Fees: Facilitating transactions and smart contract executions across the network.

-

Staking: Validators stake $BERA to secure the network, with higher stakes increasing the likelihood of block proposal and reward acquisition.

-

Medium of Exchange: Used across Berachain’s suite of DeFi protocols—including BEX, BEND, and BERPS—which are currently in active development or testing

At genesis, 500 million $BERA tokens were allocated as follows:

-

Initial Core Contributors: 84 million (16.8%)

-

Investors: 171.5 million (34.3%)

-

Community Airdrops: 79 million (15.8%)

-

Future Community Initiatives: 65.5 million (13.1%)

-

Ecosystem & R&D: 100 million (20%)

The token follows a vesting schedule with a one-year cliff, after which 1/6th of allocated tokens are unlocked, and the remaining 5/6ths vest linearly over the subsequent 24 months.

-

Circulating Supply: Approximately 119.64 million $BERA tokens as of May 2025

-

Market Capitalization: Approximately $368.3 million as of May 2025

An annual inflation rate of around 10% is subject to governance adjustment via $BGT voting.

Institutional Integration

Berachain has formed several major institutional partnerships:

-

Google Cloud: Operates a Berachain validator; also provides BigQuery access and $200K in credits to ecosystem startups.

-

LayerZero: Will serve as Berachain's canonical omnichain bridge provider.

-

Magic Eden: Launching Berachain-native NFT marketplace and collaborating on early NFT projects.

-

Paypal USD (pyUSD) and USDT0: $HONEY, Berachain's overcollateralized stablecoin, is designed to be backed by assets such as pyUSD and USDT0 through smart contract integrations.

Goldsky, The Graph, and Dune: Provide data infrastructure, analytics, and indexability for the chain.

Competitors

Berachain’s closest competitors include:

-

Cosmos chains (e.g., Osmosis): Interoperable but fragmented governance and liquidity.

-

Sei Network: Also focuses on high-performance DeFi infra but lacks multi-token PoL.

-

Monad and Eclipse: Competing on EVM performance and execution but still early-stage.

Berachain’s unique PoL mechanism gives it an edge in aligning liquidity with block production, a challenge for most Proof-of-Stake chains.

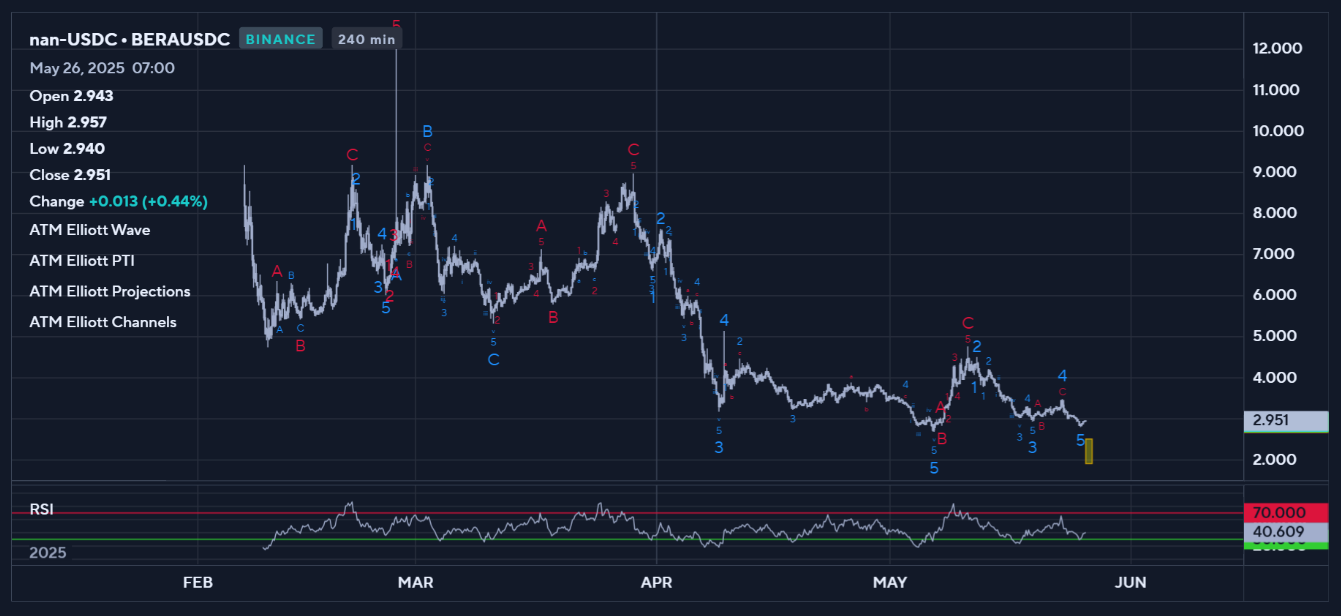

Price Outlook & Analysis — Commentary by Nathan Batchelor

Short-term Target

$3.00 - $3.30 USD

Positive setup with an ongoing extended 3rd Wave higher, expected to reach $3.00+, final 5th Wave could terminate near $3.30.

Medium-term Target

$5.00 USD

Potential turning point; a break of $3.50 signals bullish trend change, with $5.00 as ultimate confirmation.

Long-term Target

$9.00 - $12.00 USD

Possible if a structural shift occurs, with $5.00 becoming support. Worst-case scenario noted at $2.00 USD.

Short-term Analysis

In the short-term the technical back-drop for BERA looks positive according to the lower time frame Elliot Wave set-up. BERA has recently completed 5 Waves lower and is now in the midst of a 5 Waves higher set-up. The ongoing extended 3rd Wave higher is expected to reach 3.00 plus, while the final 5th Wave could terminate close to 3.30.

Medium-term Analysis

In the medium-term it appears that BERA is at an important turning point according to Elliot Wave analysis as the final 5th Wave could actually be complete and a reversal coming. In order to determine a bullish trend change any coming corrective waves need to go so far that it breaks a swing high. A break of 3.50 would be a strong signal, while a move to 5.00 would be the ultimate confirmation.

Long-term Analysis

The Long-term picture for BERA shows that now could be a good time to look at this cryptocurrency as the ongoing downtrend could be close to an end. The absolute worst case scenario would be a move to 2.00.

In terms of bullish targets over the long-term horizon BERA could easily acheive 9.00 to 12.00 again if we see a structural shift, with 5.00 becoming former resistance turned support, and invalidating the chance of a move to 5.00 just being a corrective move rather than a new bullish trend.

Conclusion

Berachain's innovative approach, particularly through its Proof-of-Liquidity (PoL) consensus mechanism, positions it uniquely in the blockchain landscape. By aligning liquidity provision with network security and governance, Berachain incentivizes active participation across its ecosystem. The structured tokenomics of $BERA, combined with its utility in transaction processing and staking, underpin the network's functionality and growth. With a robust infrastructure and a growing suite of DeFi applications, Berachain is well-positioned as a next-generation Layer 1 platform.