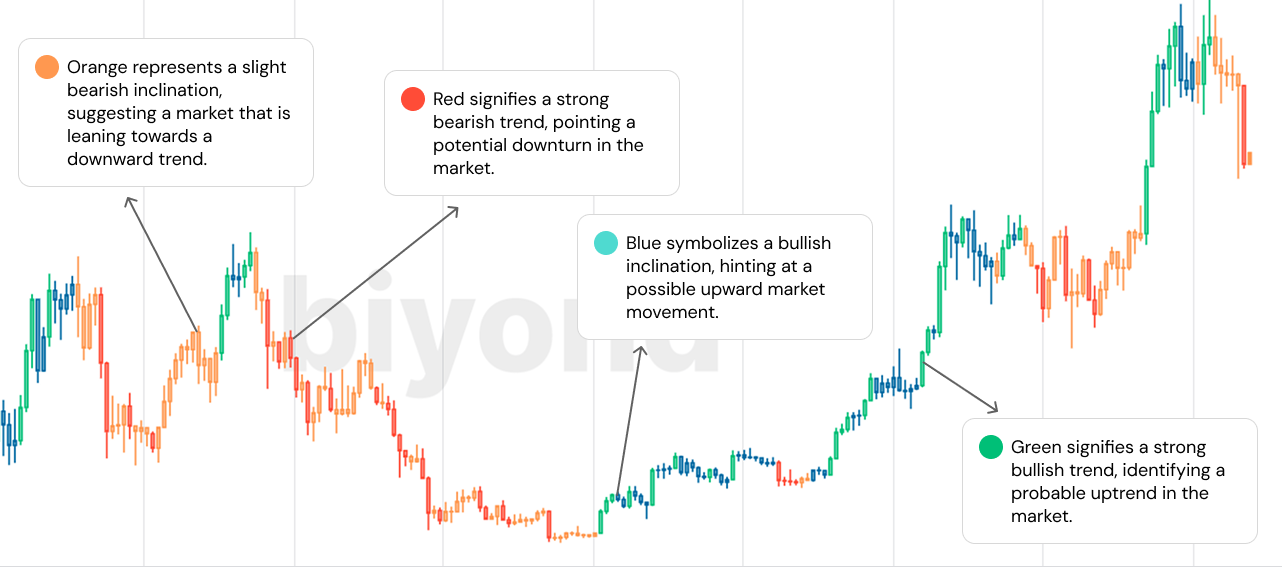

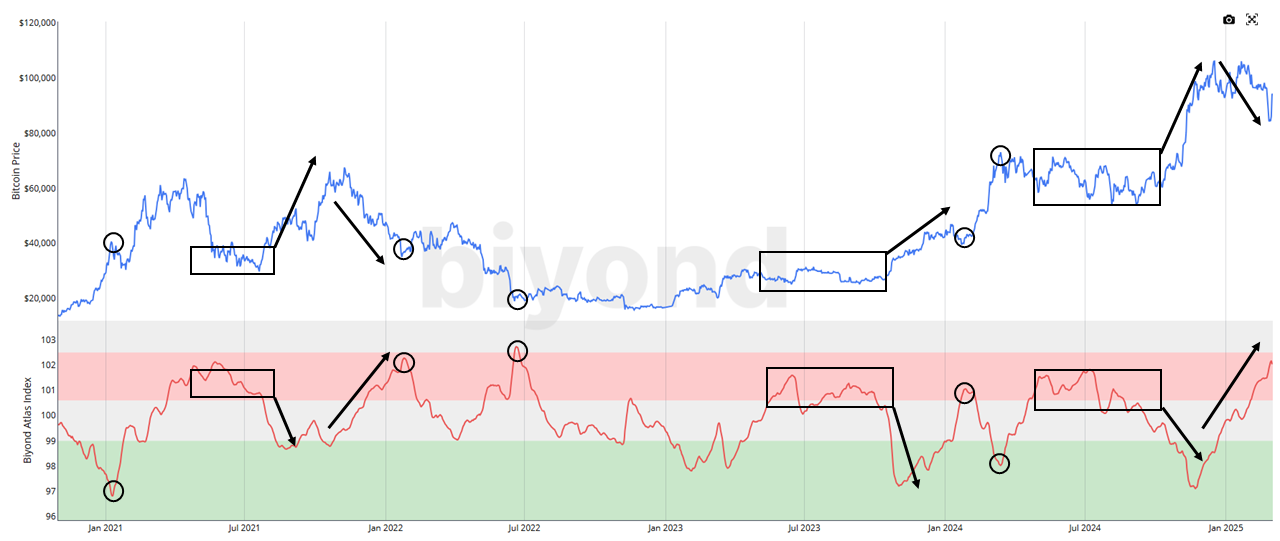

Vanguard offers a cutting-edge trend-based trading system. By leveraging innovative algorithms to interpret price action and momentum, it provides traders with clear insight into market trends across a broad spectrum of cryptocurrencies. Red for strong bearish trends, Orange for bearish inclination, Blue for bullish inclination and Green for strong bullish trends - delivering essential market behavior insights.

Strengths:

- Provides high conviction for trend following

- High sharpe ratio ranging from 3 to 6

- High win rates (~60%)

- Low drawdown (~20-25% from highest balance)

- Applicable to low and high timeframes

Weaknesses:

- Preventive, but not predictive

- Non-factor based

- Do not feed from blockchain