Bitcoin has had a hugely volatile week after making a new all-time high and then crashing lower toward the bottom it's trading range around $92,000 shortly after the Federal Reserve meeting.

With the defined short-term trading range now this massive ($92,000 to $102,000) it is not surprising to see the large bounce from the range low after it held firm during the last downside attack.

Source: Tradingview.com

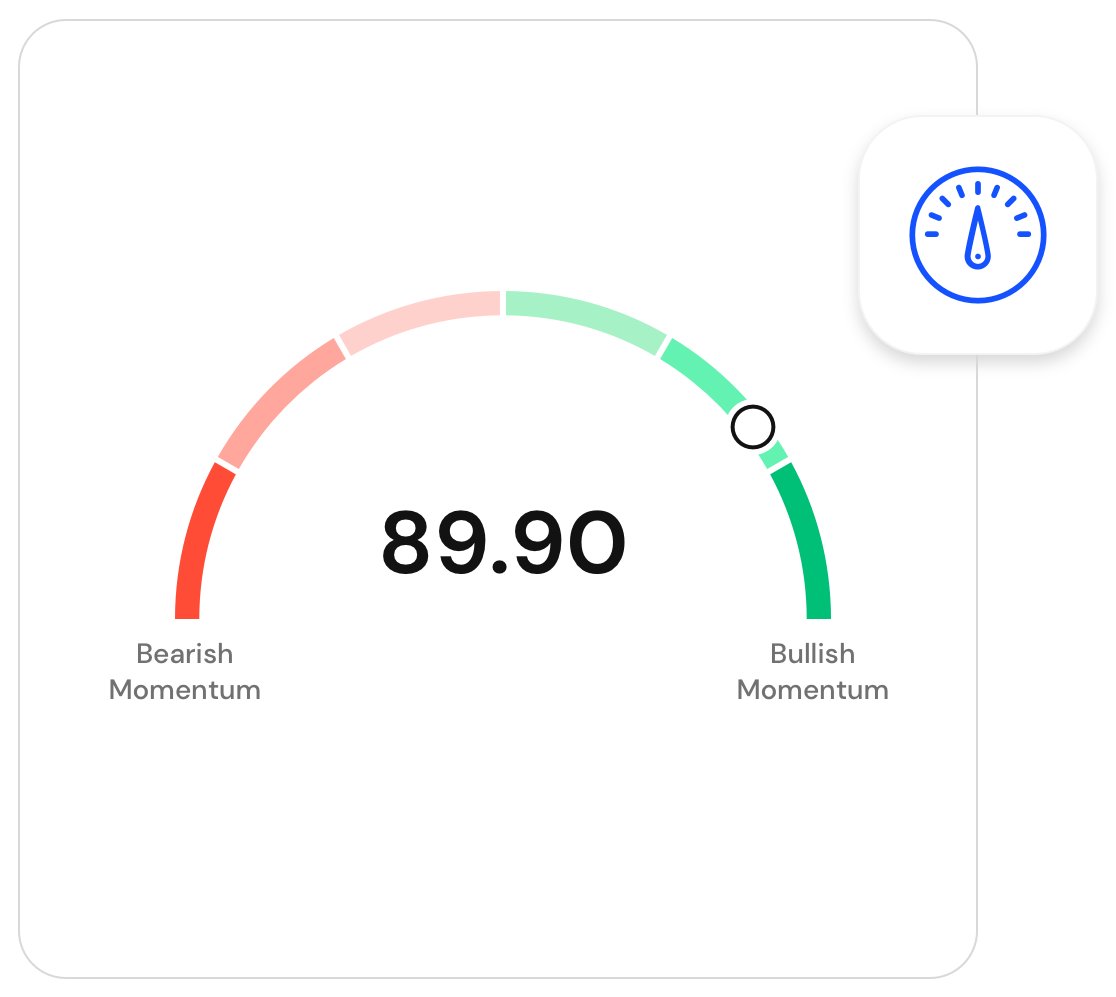

Going into next week Biyond Atlas is still indicating that price rallies are unlikely to stick as the indicator inches towards moving out of the Green "Buy Zone".

Should we see a move away into the "White Area" as seen on the chart, we could rationally expect some downside ahead.

Source: Biyond.co

As you may or may not be aware the threshold for bullish Vs bearish for Atlas is the 100 marker.

This could mean we see a test of this threshold if downside momentum gathers. I am also open to the idea of more upside if the indicator reverses downward.

This could probably only happen if we soon saw a definitive price close above the $105,000 to $106,000 level.

Source: Biyond.co

Vanguard is also one to watch next week. The indicator got off to a flying start as it turned Green again and Bitcoin rose towards $108,000.

Very honestly, it is unlikely that the indicator would have a Green buy signal and the market did not continue to rise. Even after this weeks massive price drop.

The issue we have now though is that Vanguard and Atlas are not currently aligned. The best and most meaningful trending moves happen when they are moving in harmony with one another.

Should we see Vanguard turning Orange on the weekly time frame and the price moving under $92,000 then a larger decline would be a no-brainer.

Source: Tradingview.com

As things stand Vanguard 2.0 is now Blue on the weekly time frame, meaning that Bitcoin is just slightly bullish. This creates a very uncertain environment while Bitcoin is below $100,000.

The Long Vs Short ratio exploded higher this week and Bitcoin subsequently and naturally crashed lower.

Source: Biyond.co

I would highly suggest keeping a close watch on this metric next week.

The only issue with the indicator is that you need to trade from extremes. The Long side is not currently at extremes. So more downside is indeed possible.

Overall, Bitcoin is not a straight forward trade over the Xmas holiday period. There is as much evidence that it can head higher as much as it can lower.

I would suggest waiting until Vanguard and Atlas align with each other if you are tempted to hold either Long or Short positions.

Personally, I feel the announcements surrounding the crypto intentions from the Trump administration will play a large role in the next major move.