This week it all came together for Bitcoin and also our Biyond indicators as the crypto market finally entered into a bull market.

For many months I had been pointing out that the direction of travel was likely to be to $90,000 if Trump secured a win, and after a delayed reaction it all played out exactly as planned.

What was even more satisfying was that it all came together perfectly with Biyond's indicators. Not least the highly regarded weekly Green buy signal for Vanguard.

Source: Tradingview.com

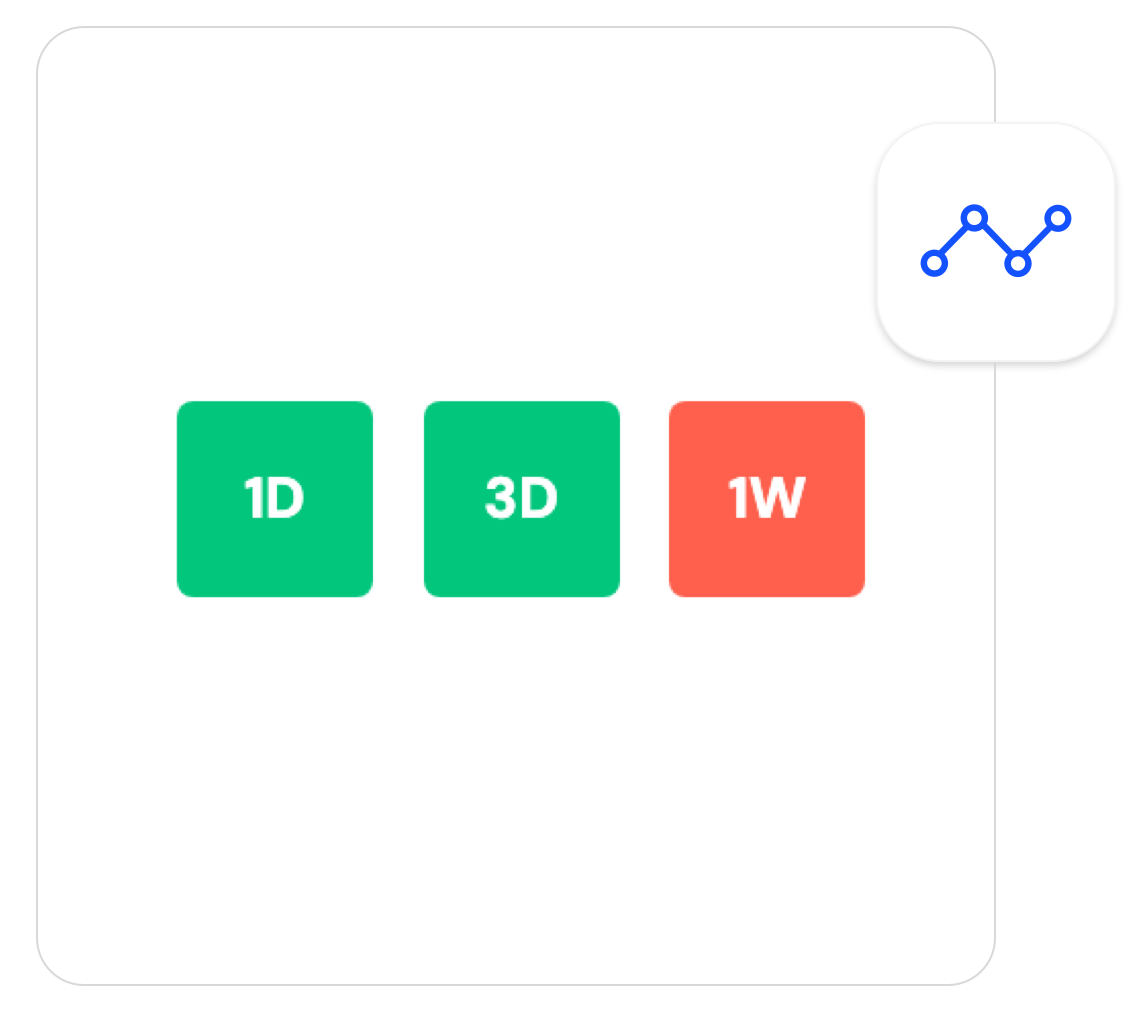

On Monday Vanguard printed its first legit Weekly buy signal (Green) in many months. And the rest is history.

What is even more impressive is that the most effective strategy from backtested results is combining the 12 hour Vangaurd with the Weekly Vanguard time frames.

We saw the immediate results after the 12 hour flashed Green, and Bitcoin quickly started to surge. It was certainly worth the wait. But where is Bitcoin going to trade to next?

Source: Biyond.co

I think one of the key points today is that while Vanguard is still printing Green it's not wise to attempt to short the market.

So buying dips seems best according to our models and back-tested results. Especially if we slump down to the lower end of $80,000.

Biyond Atlas worked fantastically in the lead up to the move, however, things are far from clear. And honestly this can be a drawback when using Atlas.

Source: Biyond.co

Atlas is now approaching its most overbought ever. But the price action and Vanguard disagree right now.

Should we ignore Atlas? Probably not, but maybe wait for a reversal as this is a momentum based model, and it is still saying upside momentum rules, even though its very very overbought.

Source: Biyond.co

The Long Vs Ratio continues to short a completely protracted short squeeze in play, which has been going on for weeks.

This really does compare well with Santiment Supply Distribution well, which shows small retail holders selling at exactly the wrong time.

Moving into next week the trend is still bullish until it's not, meaning dips are for buying and especially with the weekly

Vanguard in Green.

How high could Bitcoin run into Xmas? probably $96,000 to $100,000 can't be underestimated at this stage.

Source: Tradingview.com

Consider this, the traders who went Long on the break of $32,000 in 2023 are looking for 3x. So $96,000 fits the bill.

Traders who bought the slump under $50,000 just a few months ago are looking for 2x at $100,000.

Major profit-taking after those targets have been reached in 2024 could set about the next 2x buy-the-dip opportunity in 2025 around the $70,000s if we are lucky.