Bitcoin rallied close to the $100,000 level this week after bouncing from its weekly pivot point around the $90,000 level as I suggested it could during my daily newsletter on Monday.

During the upcoming trading week, our indicators suggest more upside is possible, however, it may not be that simple.

I think the notion of hedge fund booking profits around or above the $100,000 level is a sound one, plus global liquidity is starting to slow down into year-end.

Source: Fastercapital.com

We must also consider that the market is somewhat overstretched in the short-term, but is possible to still head considerably higher in the next parabolic phase.

I think if are incredibly lucky the mentioned profit booking and reduced liquidity could cause a 20% plus correction before the next major price increase above $100,000.

In my daily newsletter tomorrow I will be mentioning the likely path for the week ahead, giving my two most probable scenarios.

Source: Biyond.co

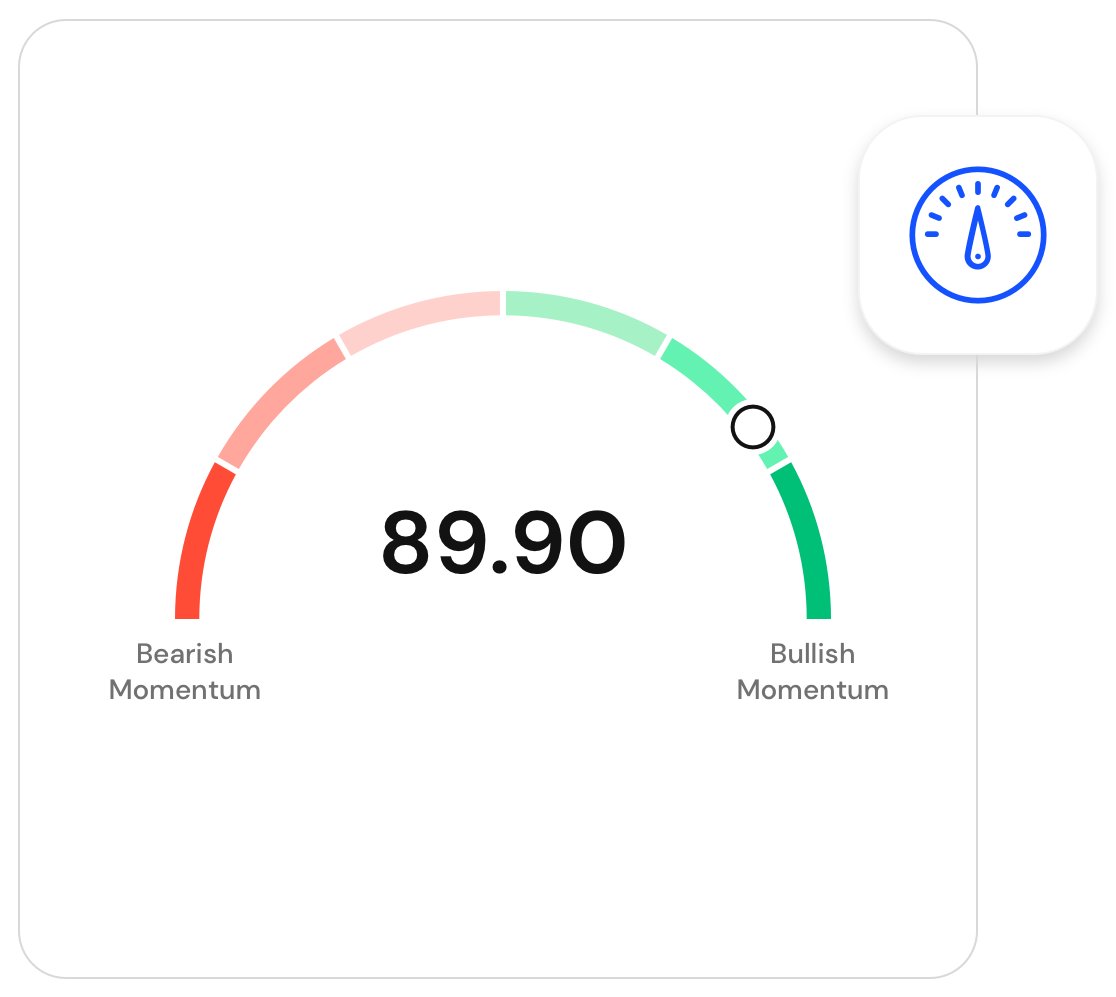

Our indicators are bullish, with Vanguard weekly continuing to generate the 3rd weekly Buy signal.

This alludes to dip-buying ruling the day still. However, some of the Vanguard lower time frames are issuing warnings.

I'd suggest keeping a close eye on the 12-hour and daily time frames next week, as an amber alert could be coming.

Source: Biyond.co

Our excellent 12-hour Green and Weekly Green Vanguard model has been a "Tour De Force" for our clients seeking short-term exposure to this bull market.

I highly pay attention to not attempting short trades while that combo flashes. The point being 12-hour Amber alert or Red alert gives me the encouragement to expect a deeper retracement next week.

Source: Biyond.co

In terms of Biyond Atlas, the indicator remains entrenched in Green mode, meaning Buying Bitcoin is the way forward still despite how far the price has been going north recently.

It is much the same for our Long Vs Short model sampling Global Binance accounts who have been trapped in the largest short squeeze I can imagine.

Source: Biyond.co

I remain medium to long-term bullish going into next week. However, we may get lucky and start to see a decent retracement for the mentioned reasons.

A move under $80,000 is the Christmas gift I am looking for, and more so for our clients and subscribers.

To summarize the above, my stop loss would be under $69,000, with a target of $125,000 plus if we got the correction under $80,000.