The recent Bitcoin price ramp above $50,000 has started to slow down, with BTC now clearly stopping and unable to make new daily and weekly price highs.

Certainly, this could just be a pause in the broader trend before lift-off towards $54,000 or even $58,000, however, a notable bearish sign has emerged that is worth consideration.

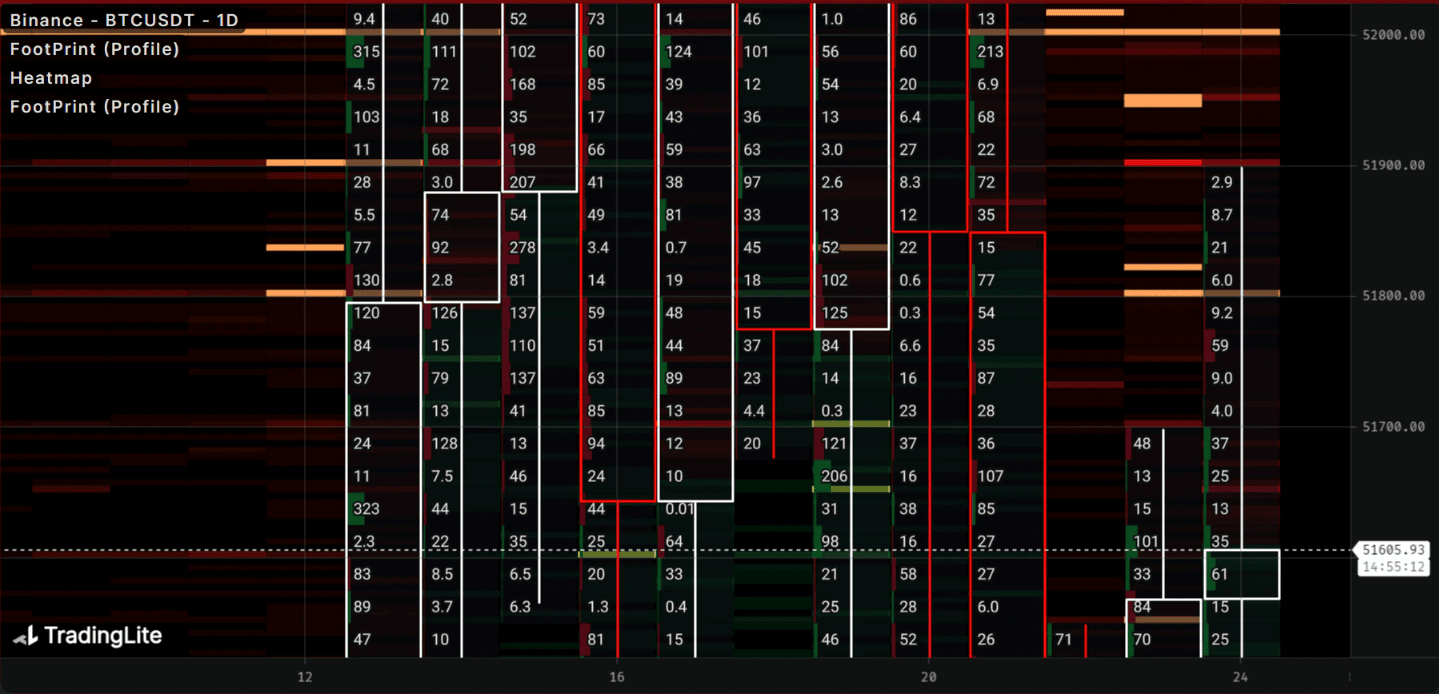

Source: Tradinglite.com

Before I touch on the Order Book signal, which you undoubtedly guessed from the title of the article I would like to touch upon a fundamental observation.

Should Bitcoin fail to rally anymore pre and post-halving then traders will be left scratching their heads thinking that doesn't Bitcoin always rally because of the halving right?

Should this happen, and the halving and ETF news is already priced in or baked in this leaves trades with a eureka moment, that without any more good news priced in then, Bitcoin could start to sell-off and especially if a bearish catalyst or broader market risk aversion kicks in or overbought stocks unravel.

Source: www.cnn.com

JPMorgan claims Bitcoin’s upcoming halving effects are already reflected in its current price range of $50,000-$52,000.

The bank notes that Retail investors are jumping back into crypto, fueled by the recent gains in Bitcoin and Ethereum.

Plus, they state that BTC’s flow from smaller wallets has outpaced institutional investments, despite new Bitcoin ETFs.

Now back to the main point of the article. Recently a stack of whale sell orders has emerged on the Order Book. For argument's sake let's call these "large blocks" of orders.

Source: TradingLite.com

One thing is clear, once these "large blocks" start to show up it has been a strong signal that the crypto gods do not want the price to pass where the sell orders are stacked, and usually the price goes in the opposite direction to where the orders are stacked.

Currently, these orders are set around the $54,000 level. This is the area to watch pre and post halving in my opinion. If defended it leaves BTC incredibly exposed to a big turn lower.

Source: Tradinglite.com

Previous examples of these large space invader-type blocks showing up have been during the decline from $49,000 after the ETF FOMO first faded in January and also the price defense of $35,000 last year.

Source: Tradinglite.com

Interestingly, these "large blocks" appear to be exclusively linked to Bitfinex exchange, and not other exchanges.

Looking at the other exchanges Binance has a heap of Buy Orders between $37,000 and $36,000 which comes as no surprise to me.

Overall, keep an eye on the $54,000 level over the coming days and weeks, and do keep an open mind about the halving.

I ofcourse could be wrong, but I think the sell blocks are worth pointing out as a major breakout or reversal spot for Bitcoin.